- #FREE PERSONAL BUDGET APP HOW TO#

- #FREE PERSONAL BUDGET APP ANDROID#

- #FREE PERSONAL BUDGET APP SOFTWARE#

- #FREE PERSONAL BUDGET APP FREE#

This budgeting software also has an autosave feature that allows you to create automatic rules to make saving easier. You can also set unlimited financial targets and track your progress as you move closer to your goals.

#FREE PERSONAL BUDGET APP FREE#

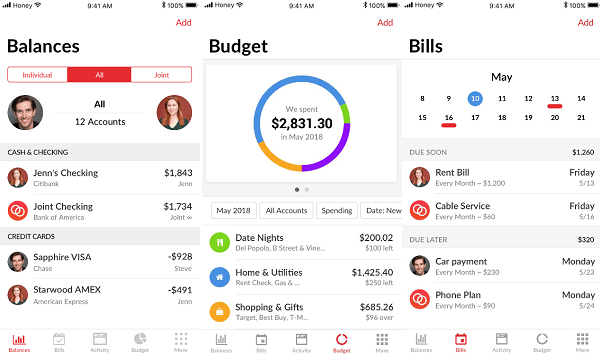

You can use this free budget app to set budgets and track your spending throughout the month.

PocketGuard users rate this app as the best budget tool to create custom budget and track purchases. PocketGuardīest for: Helping you stick to your budget and avoid overspending.

#FREE PERSONAL BUDGET APP ANDROID#

Alternatively, you can sign up for a Ramsey+ Membership, which costs $129.99/year and includes a personal finance course, budget app EveryDollar, and the BabySteps app.ĭownload on: iOS / Android Budget App #4. Pricing: Free accounts with limited features are available. Plus, the premium option also provides access to other budget tools, apps, and resources to help you take control of your money. You can connect your bank accounts to the app and automate your budget. The premium version of the app offers a far more streamlined process. The free version of this budgeting software allows you to create a budget and add transactions each time you make a purchase. If you don’t, you lose the chance to make it work for you in the areas of getting out of debt, saving for an emergency, investing, paying off the house, or growing wealth.” You must tell that 500 bucks where to go. If you cover all your expenses during the month and have $500 left over, you aren’t done with the budget yet. And this budget tool is designed to help you implement his advice.ĮveryDollar helps you create and manage a zero-sum budget – where you “tell every dollar where to go.” In Ramsey’s words: Ramsey doesn’t pull any punches when it comes to managing money, paying off debt, and saving for retirement. EveryDollarīest for: Those in need of a complete personal finance solution, including budget apps, finance tools, and resources.ĮveryDollar is a budget tool from best-selling finance writer and author Dave Ramsey. (The company makes money by recommending related financial services from third-parties, such as credit cards or mortgage loans.)ĭownload on: iOS / Android Budget App #3. Plus, Mint will notify you when your credit score changes and sends you fraud alerts. Mint also allows you to “enjoy access to unlimited free credit scores, without harming your credit.” Additionally, Mint will send you bill alerts and notify you when you spend too much money or go over budget. As a result, it’s very easy to track spending by category and compare it to your budget. This free budget app automatically categorizes your transactions. This allows you to see all of your transactions, account balances, and net worth in one place. It has a massive list of banks, credit cards, lenders, and brokerages that you can connect to your account. In short, this budget app makes it easy to get a complete picture of your financial situation. You can use it to set money goals, track your progress, and get advice on personal finances. Mint provides a range of budget tools and features to help you manage your finances. It’s made by Intuit, the maker of the finance software programs Quickbooks and TurboTax. Mint is an established, well-known budget app. This budget app costs $11.99 per month or $84 per year.ĭownload on: iOS/ Android Budget App #2. Pricing: ‘You Need a Budget’ offers a 34-day free trial. It allows you to set attainable targets to help you feel good about tackling big, scary debts.

#FREE PERSONAL BUDGET APP HOW TO#

This budget tool teaches you to manage your debt effectively and how to save money mindfully. Plus, it has a dedicated feature to help you pay down your debt. It’s great for individuals and couples who want to set savings goals and manage a budget together. You can access this dashboard on mobile or desktop. This budget tracker allows you to connect all of your accounts to one money management dashboard. The idea is to “give every dollar a job.” This way, you’ll spend every dollar intentionally and won’t fritter money away on unimportant purchases. You Need a Budget is an advocate of the zero-sum budgeting strategy. This budgeting app claims that on average, new budgeters save $600 in the first two months of using the app, and more than $6,000 in the first year.” Not bad, right? You Need a Budget is a very popular budget app with a die-hard following who lovingly call it, “YNAB.” Best for: Committed budgeters who want granular control of their money.

0 kommentar(er)

0 kommentar(er)